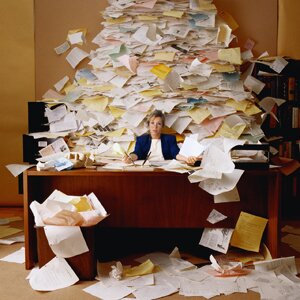

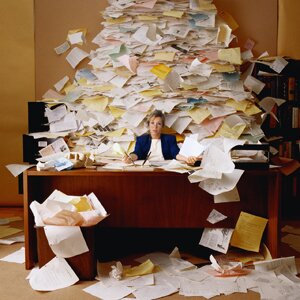

In a nutshell, bookkeeping is the process of keeping records of the financial aspects of a business. It deals with anything financial such as purchases, sales and cash transactions. Think of it this way, it’s everything a person who hates math hates.

In a nutshell, bookkeeping is the process of keeping records of the financial aspects of a business. It deals with anything financial such as purchases, sales and cash transactions. Think of it this way, it’s everything a person who hates math hates.

If you have a business, whether it’s big or small, it’s very important that your books are in order. Aside from knowing how much money you are earning and how much money you are spending, it’s important for a number of other reasons.

If you are planning to seek outside capital, or feel that you would need it in the future, it’s important that your books are in order. Lenders and investors require complete and accurate financial data before granting your request for financing.

Taxes – this is one of the most important reasons for keeping balanced books. In order for you to know how much to pay the IRS, you must have an accurate account of your income as well as your expenses. Bad documentation of these could result in fines or penalties. But more frequently, it results in the overpayment of taxes due to the incomplete documentation of legally allowable expense deductions.

Bookkeeping shows the business owner where the business stands, which is necessary in order for a business venture to grow. Once the bookkeeper prepares necessary information, he/she would then submit this to an accountant who would analyze the record and come up with a financial statement. There are financial firms that provide both bookkeeping and accounting services. This alleviates the need to have two professionals in order to obtain complete accounting services available.

These are only some of the reasons why EVERY business should maintain proper bookkeeping techniques. There are some business owners who are only interested in making profits and handling the business. This is not a reason to ignore bookkeeping. If you are such an owner, you can always opt to hire a bookkeeper instead, thus freeing your time so that you have the hours available to work on your business’s revenue producing areas. Many times a business owner is able to generate more revenue in the time he saves by hiring a bookkeeper than he actually spends on paying for those services.

There should be more than a handful of bookkeeping firms in your area, but you should make sure to look for the best. Your bookkeeper should also be a person who you are able to communicate with easily and who you are comfortable working with on a regular basis. The people that you hire should be experienced in the field, and be willing to provide references so you know what you’re getting.

Call us today at 334-246-1164 or email us at st***@*****************ng.com and let’s talk about how we can help you bookkeeping services in Auburn, AL.